Some Known Factual Statements About "Understanding the Basics: A Guide to Health Insurance Coverage Options in Indiana"

Matching up Health Insurance Plans in Indiana: What You Need to have to Know

Health and wellness insurance coverage is a vital aspect of securing oneself from unanticipated clinical expenditures. In the state of Indiana, there are several health insurance plans on call that accommodate to the assorted needs of its citizens. Nevertheless, browsing via the different possibilities and matching up them can easily be overwhelming for lots of individuals. This write-up targets to provide a comprehensive guide on contrasting health and wellness insurance coverage plans in Indiana, ensuring that you have all the details you need to have to make an informed decision.

1. Types of Health Insurance Plans

Before delving into the particulars of reviewing health and wellness insurance coverage program, it is important to understand the different types available in Indiana:

a) Health Maintenance Organization (HMO): HMO strategy commonly demand people to select a key treatment medical professional (PCP) who acts as a gatekeeper for accessing specialized treatment. Referrals coming from the PCP are normally essential for observing specialists.

b) Preferred Provider Organization (PPO): PPO program offer additional flexibility compared to HMOs by making it possible for people to seek care from both in-network and out-of-network suppliers. While seeing in-network companies results in lesser out-of-pocket expense, seeing out-of-network companies sustains higher expenses.

c) Exclusive Provider Organization (EPO): EPO strategy incorporate elements of both HMO and PPO planning. They demand people to keep within a system of providers but do not mandate recommendations for specialist visits.

d) Point of Service (POS): POS plans also mixture parts of HMO and PPO planning. Comparable to an HMO program, people decide on a key treatment physician who works with their medical care necessities. Nonetheless, they possess flexibility like PPOs when looking for treatment outside their network.

2. Coverage and Benefits

When reviewing health insurance strategy in Indiana, it is vital to analyze their protection and advantages comprehensively:

a) Medical Services: Determine what clinical services are dealt with under each strategy – a hospital stay, physician gos to, precautionary care, prescription medicines, psychological health and wellness services, and unexpected emergency care.

b) Network Providers: Figure out if your liked medical care companies are part of the planning's system. In-network service providers commonly lead in lesser out-of-pocket costs.

c) Prescription Drug Coverage: Take a look at the formulary of each program to establish if it covers your required medicines. Assess copayment or coinsurance costs for prescribed medicines.

https://www.getsmartquotes.com/indiana-health-insurance/ ) Out-of-Pocket Price: Compare deductibles (the amount you spend just before insurance coverage kicks in), copayments (fixed quantities paid for particular services), and coinsurance (percentage of expense discussed with the insurance coverage provider).

e) Additional Benefits: Some strategy use additional perks like dental and vision insurance coverage, wellness systems, or telemedicine companies. Assess these add-ons based on your personal requirements.

3. Cost Considerations

Affordability is a notable element when matching up health and wellness insurance strategy:

a) Premiums: Costs are the taken care of month-to-month expense you pay out for preserving protection. Compare premiums among various program while thinking about your finances and medical care requirements.

b) Deductibles and Out-of-Pocket Maximums: Much higher deductibles commonly suggest lesser costs but much higher out-of-pocket expense when getting health care care. However, lesser deductibles commonly result in higher fees but lower out-of-pocket expenses. Assess how a lot you may afford to spend upfront against throughout the year.

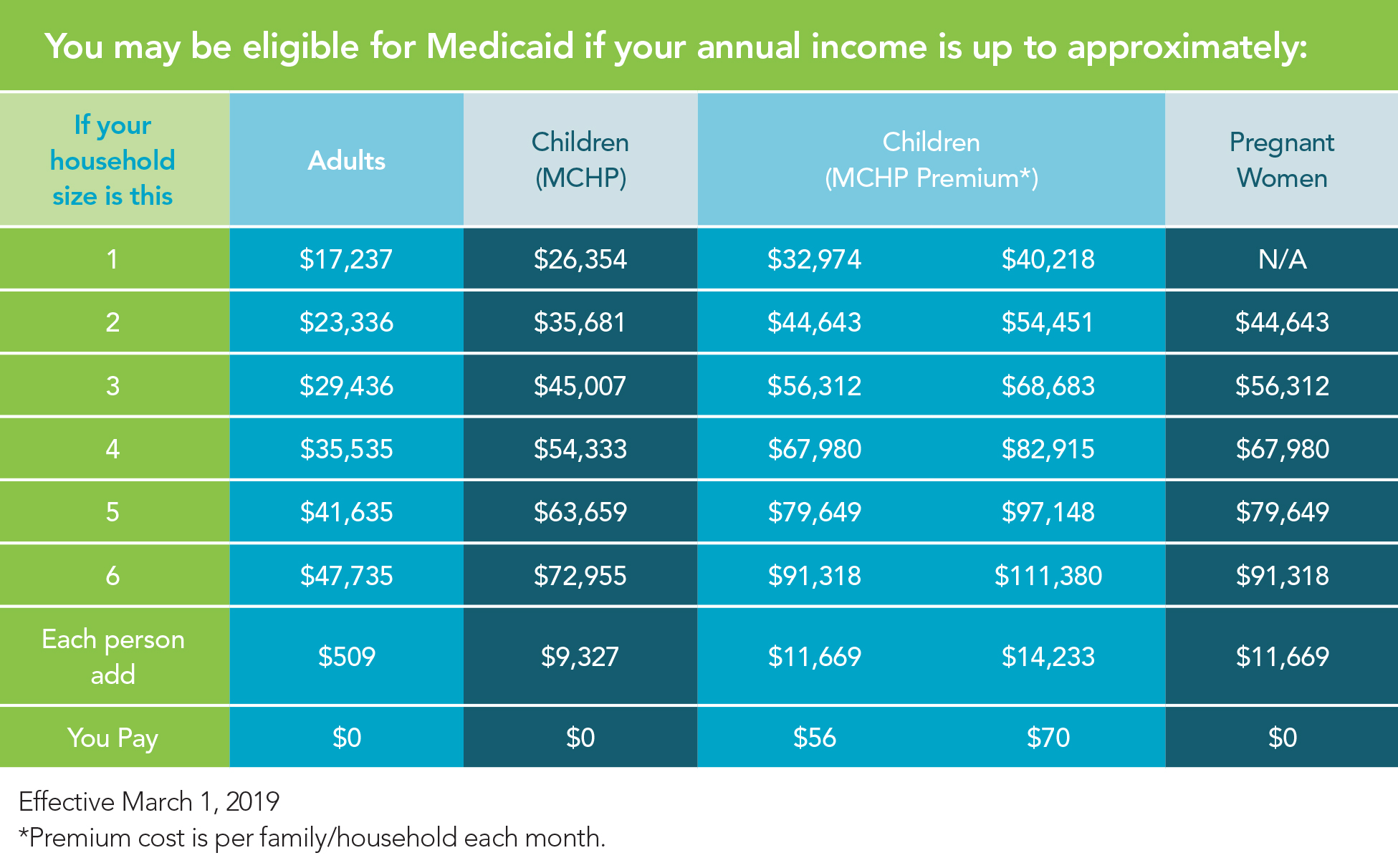

c) Subsidies and Tax Credits: Depending on your profit degree, you might be qualified for aids or income tax credits that may substantially reduce your superior price. Check out if you certify for any sort of economic support when reviewing strategy.

4. Provider Networks

Understanding carrier systems is vital as it influence the ease of access of healthcare companies:

a) In-Network Providers: Identify if your preferred medical professionals, hospitals, specialists, or clinics are part of a strategy's system to guarantee they fall within the coverage parameters.

b) Out-of-Network Companies: If you possess particular carriers or specialists you desire to see, confirm if they are covered through the strategy or think about a plan with a more comprehensive system.

c) Referral Requirements: HMO program typically require suggestions coming from primary care physicians for specialist check outs. Evaluate if this lines up along with your medical care choices.

5. Health Insurance Marketplace

Indiana runs its very own health and wellness insurance coverage industry, known as the Indiana State-Based Exchange. The market place permits citizens to contrast and purchase health and wellness insurance policy strategy online. Discover the market website to compile info on on call plans, costs, and subsidies.

Contrasting health insurance policy plans may be complicated, but taking the opportunity to understand each strategy's protection, advantages, costs, and service provider networks is critical for helping make an informed choice. Think about your medical care necessities and monetary constraints when examining different choices. Utilize sources like the Indiana State-Based Exchange to gather information and look for assistance from licensed insurance coverage agents if needed. By comparing health and wellness insurance coverage plans efficiently, you can easily locate a strategy that fit your criteria and delivers economic surveillance in times of medical need.

In verdict, understanding the styles of health and wellness insurance policy plans offered in Indiana, examining coverage and benefits totally, considering expense elements like premiums and deductibles, assessing company systems completely, and using the state-based swap are important measures in comparing wellness insurance policy program successfully in Indiana. With this expertise at hand, you may help make an informed selection that makes certain appropriate protection for your healthcare demands while additionally being fiscally sustainable.